A look at recent SIA statistics

by Craig Dostie

Companion article on WildSnow

Back then we knew that 80% of our readership were telemarkers, 25% were using Alpine Touring gear, and about 5% were snowboarders. That was around 1996.

The first time backcountry skiers showed up on the industry’s statistical radar was in 1999, when Leisure Trends reported telemark skiers accounted for 1.7% of the US ski universe. It wasn’t a lot, but it was encouraging to see we had started to show up.

By 1999 Couloir’s readers were using AT 35% of the time, tele was down to 75%, and snowboarders were 15% of our readership. The extra percentage indicated a fair number of folks who were switch hitters. By 2003 tele was down to 60%, AT up to 45%, and snowboarder’s accounted for 20% of Couloir’s readership. Though it wasn’t perfect, it was the most comprehensive analysis of the backcountry crowd at the time.

Fast forward to the present. The SIA Intelligence Report for 2009 arrives in my inbox and a quick browse indicates the rumors that “tele is dead” are exaggerated or SIA still can’t get their numbers right, or both.

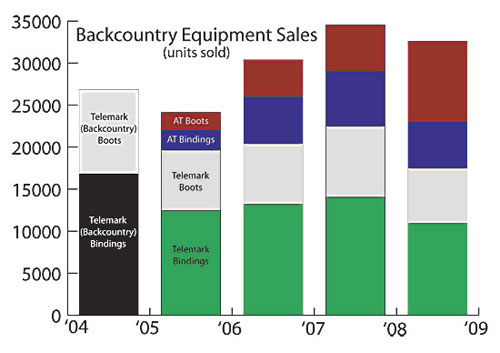

Here’s the same graph as on Wildsnow on backcountry equipment sales for the past five years.

The most obvious thing is that sales of backcountry equipment continue to grow. Less obvious from this graph, but nonetheless evident is that sales of AT boots are growing faster than any other backcountry category. However, even though the trend for AT is up, and for tele it is down, it isn’t down dramatically.

In fact, the biggest selling category for backcountry specific products remains telemark bindings. Guess maybe a lot of folks are waking up to the advantages of a free pivot after all. That’s my guess as to why the numbers are so high there.

One thing outside observers don’t understand. Telemark isn’t going away because telemarkers are more fanatical about skiing. I’m not saying snowboarders or alpine skiers don’t get fanatical, some do, and some, like Andrew, are even crazier. On average though, pinheads are more so. You have to be to be a telemarker ‘cuz it doesn’t take a genius to realize that if it’s harder to do and you’re using non-releaseable cable bindings, well, then telemarking is stupid. The problem is, that fails to recognize that as a group we’re stupid for telemark ‘cuz there ain’t no turn like tele. It’s more than just skiing, and it’s more than just a turn, it’s a mistress and we won’t give her up easily.

All the same, these numbers don’t tell the whole story, because an important group, outdoor specialty retailers are absent from the stats. Based on conversations with backcountry retailers the past few years, that means their perspective that AT has not just led, but dominated equipment sales is absent. Blame me for believing them and thus the reason for my surprise that tele was doing so much better than expected. It still is, but AT is doing even better than the numbers indicate.But that was only part of the story. The truly unexpected statistic was how many telemarkers there are in the United States at the end of last season (Winter 2010). According to SIA, it was 1.4-million.

No Way!

I called Kelly Davis, Research Director at SIA and she said, “WAY!”

Then she explained why. More survey interviews yields a smaller margin of error. The increase in participation numbers is due to changing what defines participation. The old surveys required participating twice, the new survey only once. The result was numbers increased about 40%.

In that case, these numbers aren’t so bad. I still don’t think there are even 600,000 telemarkers in the US. Maybe 600,000 or even 750,000 backcountry skiers, but not that many tele.

As ever, the exact numbers may be disputed but trends they reflect are really encouraging. Interest in backcountry, or free heel skiing has clearly grown. Even if you prefer, as I do, to interpret telemark skiers as backcountry skiers, that means we account for about 10% of the total ski population in the US, give or take a few points.

There may be a ton of economic doom and gloom out there, but backcountry skiing just keeps on growing, in spite of, or maybe perhaps because of the worldwide economic contraction.

I remember saying that backcountry skiing would really take off when lift ticket prices hit $50. That was around the turn of the century. Serendipitously it was also when Fritschi introduced the FreeRide binding, the first binding that looked beefy enough to stand up to American skiers macho self image. From that point on the growth in backcountry skiing has been steadily increasing, due in part to bindings like the FreeRide, and more recently Marker’s Duke. And the ever increasing cost of ticket prices hasn’t hurt motivation either, with SIA reporting the average ticket is now almost $75.00.

Maybe there really are more than a million backcountry skiers out there, maybe 1.4-million telemarkers isn’t such a stretch.

Updated numbers from SIA (includes 09/10)

© 2010

1 ping

[…] Related Post 1.4 Million Telemark Skiers? […]